Best streaming services for movies and TV shows 2025

Battle of the video-on-demand streaming services

Streaming services have taken the entertainment world by storm in the last few years. What started with Netflix being an alternative to pricey TV subscription packages is now an endless stream of services from massive corporations such as Disney, Apple, Amazon and Paramount.

Pricey monthly bills, reams of content that span every imaginable genre and a confusing new tier system which locks certain features behind paywalls have made the world of streaming more complicated than ever before; so which one is worth subscribing to?

That's the question we're here to answer. We're willing to bet you've raised an eyebrow or two at the rising costs and have considered which ones to keep and which ones to ditch.

That's why we've reviewed and ranked the top four options on the market, and assessed what they do best. Which one you'll prefer will depend on your preferences and desire to watch their respective original programming options.

That being said, picture and sound quality remain a key factor in their success, and one service does excel at delivering high-quality content with AV prowess in mind.

You'll likely want to pair one of these services with one of the best OLED TVs and an entry from the best Dolby Atmos soundbars list for the best results, so be sure to check out those lists to complete your home cinema setup.

With that out of the way, let's dive into the best streaming services for movies and TV shows.

The quick list

Best for big-budget originals

Apple TV's content library has come a long way since launch, and it features top-notch picture and sound, too.

Best overall

With its extensive library of blockbusters and bingeable TV shows, many of which are available in 4K, Disney+ is our number one pick.

Best for choice

The original video-streaming service, Netflix continues to offer a great mix of movies and TV shows at a variety of prices.

Best value

With 4K included as standard, and the opportunity to add extra Amazon perks for not much extra, Prime Video is a bit of a bargain.

Load the next product… ↓

I am a Senior Staff Writer on What Hi-Fi? and as a member of Generation Z I’ve grown up with Netflix and tried every video-streaming service under the sun. I’ve been a subscriber to all of the services below at some point so I’m familiar with their catalogues and what their strengths and weaknesses are, and as a regular cinema goer I also have high standards when it comes to picture and audio quality. Even if you’re not convinced by our top choice, I’m certain I can help you find one that does suit your tastes.

- Check out the best streaming services for kids

Best overall

Specifications

Reasons to buy

Reasons to avoid

Apple's streaming service didn't make serious waves when it launched back in 2019, however, it has spent the last six years quietly working away to establish itself while its rivals jack up the prices, and its plan has finally paid off.

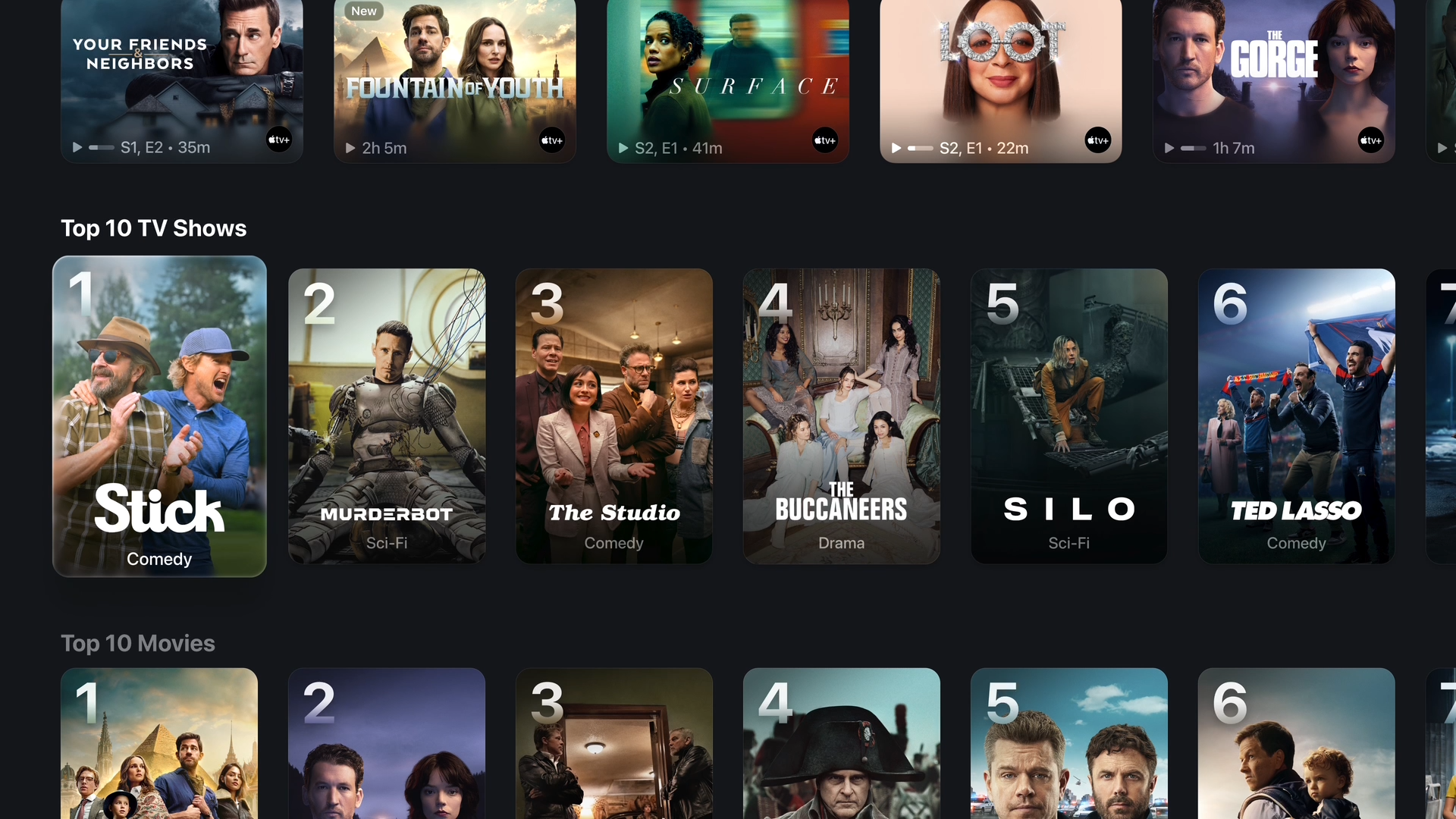

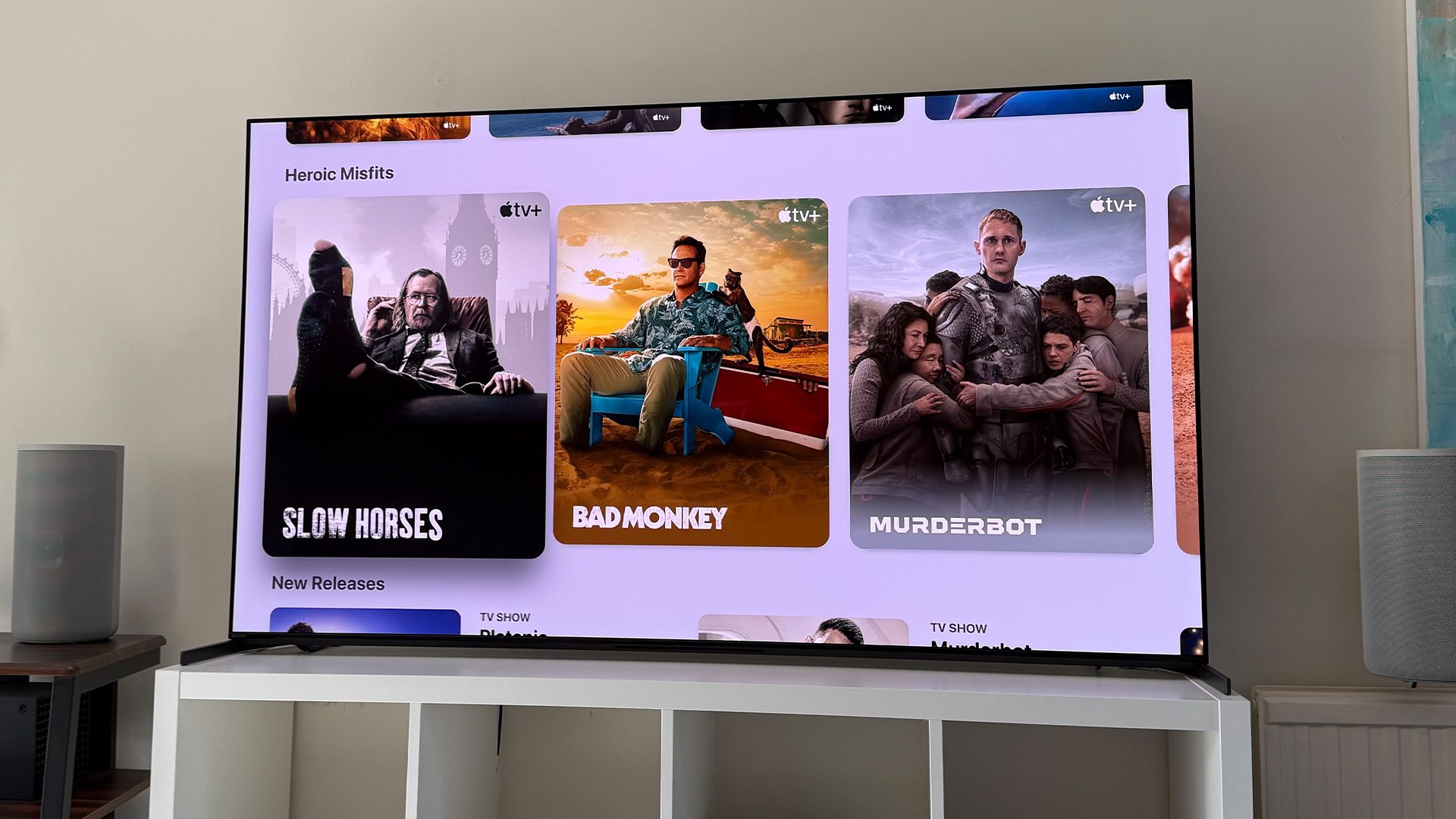

Apple TV (formerly Apple TV+) has become our top streamer of choice thanks to its superb picture and sound, and its surprisingly impressive library of original content.

It's scooped up numerous high-profile awards for its original programming and movies, including a Best Picture Academy Award for CODA and various Oscar nominations for the likes of Napoleon and Killers of the Flower Moon.

Its TV shows have been met with similar acclaim, with Emmy Awards achieved for The Studio, The Morning Show, Severance, Shrinking and Slow Horses.

We're impressed by its excellent 4K picture, which also supports Dolby Vision and HDR10+, and Dolby Atmos audio is included too. Best of all, Apple includes all of these at a reasonable all-in-one subscription price of £9.99 / $12.99 / AU$15.99 per month.

There are no ads, and no various tiers that segment the features into different price brackets. It's simple, straightforward on-demand entertainment, which we appreciate considering all of the other options on this list insist upon pricey premium subscription tiers for 4K HDR streaming.

Read the full Apple TV review

11 best Apple TV+ shows and films

Best for blockbusters

Specifications

Reasons to buy

Reasons to avoid

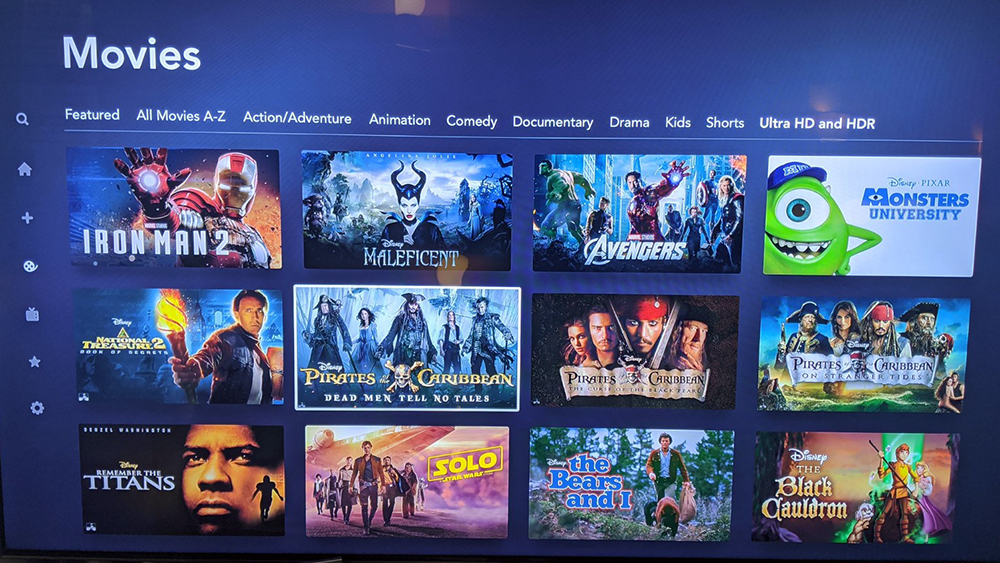

Disney+ might be the newest member of the video streaming ‘big four’, but it's made a serious name for itself over the last few years.

Not only does it have a vast back catalogue of Disney classics (think Sleeping Beauty, Aladdin, Dumbo etc), but the House of Mouse’s ownership of major studios such as Marvel, Pixar and Lucasfilm means it’s also home to a huge selection of blockbuster movies, including the whole Star Wars universe.

Throw in National Geographic’s documentaries and the huge array of older movies and TV shows available through its Star subsidiary, and it’s a library that caters for much more than just the kids.

But what of the actual service itself? Well, that’s also very good indeed. Full HD comes as standard, as does 5.1 surround sound, and there's plenty of 4K HDR and Dolby Atmos content to enjoy if you subscribe to the Premium tier.

Unless you’re on the ad-supported option, you can also download it all to your device to watch on the go. The service is a cinch to get to grips with and it's available on a wide range of devices too, from web browsers and smartphones to tablets, streaming dongles and games consoles.

The subscription packages differ depending on where in the world you are. The cheapest one in the UK (£4.99 a month) does involve putting up with some ads, but the £8-a-month option (less if you fork out for a whole year up front) still works out as decent value for money. For the full 4K and Atmos experience, you’ll need to stump up £12.99 a month. In the US, even the ad-supported $9.99 tier offers 4K as standard.

Wherever you are, though, if you can only afford to subscribe to one video-streaming service make it Disney+.

Read the full review: Disney Plus

12 of the best Disney Plus shows and movies

Best for choice

Specifications

Reasons to buy

Reasons to avoid

Netflix has been at this video-streaming game since 2007, so it’s no real surprise that it’s built up an impressively deep catalogue, including some that can be considered bonafide classics.

Take your pick from Stranger Things, Narcos, Ozark, Dark or Mindhunter, plus a bunch of zeitgeisty shows like Squid Game, Money Heist, and Tiger King. Then there’s the captivating documentaries such as The Last Dance, 13th, and Making a Murderer (arguably the breakout moment that made Netflix a genuine household name). Or how about the world’s most high-octane reality show, Formula 1: Drive to Survive? If that’s not enough it has a nice line in stand-up comedy specials, too.

Admittedly it’s not so strong when it comes to movies, but All Quiet on the Western Front, Rian Johnson’s Knives Out series of whodunnits (a third, Wake Up Dead Man, is due before the end of 2025), and all three-and-a-half hours of The Irishman are certainly worth your time.

Netflix also has its fair share of dross, but filtering it out is a doddle thanks to the intuitive interface, plus it’s available on almost any device (including streaming sticks, smart TVs and games consoles). In fact, Netflix is now so ubiquitous that some remote controls now even have a dedicated button for it.

Picture quality is brilliant, too, with plenty available in 4K and HDR, plus support for 5.1 and Dolby Atmos surround sound audio. You will have to pay a pretty pricey £17.99 ($22.99 / AU$22.99) per month to access them, but full HD is available for as little as £4.99 ($6.99 / AU$6.99) per month if you’re willing to put up with adverts, or £10.99 / $15.49 / AU$16.99 if you’re not. You can download shows and films to your mobile device to watch on the go, too.

Those prices have gone up a lot over the years, but for the breadth of choice on offer and the quality of the best of it, it’s still a monthly cost worth paying.

Read the full: Netflix review

The best TV shows to watch on Netflix right now

Best value

Specifications

Reasons to buy

Reasons to avoid

If it’s value for money you’re after – and performance-per-pound is paramount here at What Hi-Fi? – Amazon Prime Video is hard to beat.

Even on its entry-level subscription, which costs just £5.99 / $8.99 per month, 4K is included as standard, and while the roster of original content isn’t quite as compelling as what Amazon, Disney, and to a certain extent Apple, have to offer, there are still some very watchable shows available here. The Boys, Fallout, Reacher, Mr & Mrs Smith, The Lord Of The Rings: The Rings Of Power, and The Marvelous Mrs. Maisel are just some of the choices, while the fly-on-the-wall All or Nothing sports series also has its moments. You’ll also get the odd live Champions League football match, too.

An ever-changing catalogue of movies is bolstered by some high-profile exclusives to tempt cinephiles into subscribing, including Challengers, The Zone of Interest, Anatomy of a Fall, Kneecap and the infamous Saltburn.

If that’s not enough value for you, you can pay £8.99 ($14.99 / AU$9.99) per month for Amazon Prime Membership (£95 / $139 / AU$79 annually) instead, which includes the standard Prime Video benefits mentioned above and adds free one-day delivery from Amazon, ad-free music streaming and more on top.

Unfortunately, there’s a catch. No matter which level of subscription you opt for, you will have to sit through some ads before your movie or TV show starts, and potentially midway through as well. It’s by no means as disruptive and annoying as the ad-fest that is Channel 4’s on-demand service though.

After a number of years with very little original material worth watching, Amazon is starting to forge more of an identity for itself as an entertainment platform. It’s still not quite on the same level as Netflix, and the ads aren't ideal, but Prime Video remains excellent value for money.

Read the full Amazon Prime Video review

22 of the best TV shows on Amazon Prime Video

How to choose the best video streaming service for you

With so much choice available these days, how do you choose? You can't subscribe to every single streaming service (if you can, we envy you); not only will the costs add up, but trying to find what you want to watch will also become unwieldy.

The first hurdle is pinpointing what kinds of TV shows and movies you like watching the most. Prefer Star Wars, Marvel and Pixar films? Disney Plus is a no-brainer. Love plenty of original content across the globe and a ridiculous amount of choice? Netflix is still the king of new 'content'. Looking for big-budget blockbuster fare? Amazon Video is a prime choice. Prefer limited but high-quality original shows? Apple TV should be your go-to.

You can also opt to subscribe to two services on the regular, for example, while dipping in and out of another's subscription depending on when a new show you're looking forward to will premiere. It's one way of keeping costs down, but without missing out on a great new show (or film).

All services offer varying tiers of subscription, from basic standard to top-tier 4K/Dolby Atmos quality. If 4K/HDR picture and Dolby Atmos audio are a must (and you have the relevant kit to enjoy this stunning performance), then it's definitely worth singling out the service that offers you the best picture and audio performance. Each service also details sharing plans and limits, which is handy if you're in a multi-person household and share your subscription with friends and family (just beware that Netflix has cracked down on password sharing, and Disney Plus is following suit).

There are cheaper ad-supported tiers popping up as well to counter the rising costs of each subscription, but there's a decision to be made on whether you're happy to suffer through ads in place of an uninterrupted 4K picture. The choice is yours.

How we test the best video-streaming services

Testing video-streaming services is certainly one of the less taxing tasks associated with working at What Hi-Fi?, but it’s not as simple or as easy as just watching hours and hours of TV.

Every service included on our list above has been comprehensively evaluated by our expert team. That involves assessing the catalogue, both on the range of what’s available and its quality, and making a judgement on the amount of content that’s available in 4K, HDR, and with Dolby Atmos audio. We’ll also score it based on how easy it is to navigate and how well labelled the content is.

The actual testing is done mainly using one of our reference TVs and speaker systems. These are Award-winning products that we keep in our stockroom full-time to be used as benchmarks. They provide a high-quality platform that allows us to make consistent judgements on picture and sound performance in our dedicated testing rooms, but with many streaming services available on a plethora of devices, we’ll also use them on mobile phones, laptops and other streaming devices to check that the experience is comparable across the board.

We will take all of this and examine it through the lens of each service’s pricing structure to come up with a final verdict, which is decided upon by the whole team rather than just an individual writer. This ensures no personal bias creeps in and allows us to be as impartial as possible.

All of What Hi-Fi?’s testing is comparative, so each of the services above has been considered in relation to the others on the market to identify a clear winner. That’s why you can trust our reviews and confidently base any buying decision on them without worrying that they have been influenced by any outside influences, such as PR representatives or sales teams.

Read more about how we test and review all products at What Hi-Fi?

FAQ

Which is the cheapest streaming service for movies and TV?

In the UK, the streaming services of the terrestrial TV channels are free to use (as long as you have a TV licence for BBC iPlayer or only watch on-demand content from the others), but of the paid options Disney+ and Netflix both have basic £4.99-a-month tiers. For that much you’ll be limited to watching in Full HD and Disney+ won’t allow you to download anything to watch offline, but the biggest drawback is that you’ll have to put up with adverts interrupting your viewing.

Which is the best streaming service for movies?

That depends entirely on your taste in films, but Disney+ and Amazon Prime Video tend to get the biggest titles first. Both also have decent back catalogues to delve into, although Amazon’s changes regularly, so don’t expect everything on your watchlist to hang around forever. Prime Video and Apple TV+ also offer add-on channels from the likes of Mubi, BFI Player, Curzon, and StudioCanal for an extra monthly charge (seven-day free trials are available), so movie buffs are particularly well catered for there.

Which devices can I use to access the best video-streaming services?

All modern internet-connected TVs now offer apps for the main streaming services, although exactly which ones are supported will depend on the manufacturer and model. You may not get full support for all video and audio codecs either, in which case you might be better off using a streaming box or stick of some sort. Our favourite is the Apple TV 4K. All of the above platforms also have mobile apps for both iOS and Android, plus they can be accessed via a web browser.

How fast does my Wi-Fi need to be to stream 4K?

There’s no hard and fast guarantee here because the speed of your internet connection isn’t the same as the speed of your Wi-Fi, but 25Mbps is generally considered to be the bare minimum for streaming 4K. If your TV is a long way from your router, or you have lots of devices demanding a slice of your bandwidth, you’ll probably need around double that for a smooth, buffer-free experience.

Recent updates

- February 2025: Adding a section on how we test video-streaming services, an FAQ, and brought all of the product entries fully up to date.

MORE:

Binge big: 7 Netflix and Amazon Prime Video streaming service alternatives

This hidden Prime Video feature has transformed my streaming – Netflix and Disney+ need it now

Netflix and Disney Plus might be convenient, but I will never part with my DVD collection

The latest hi-fi, home cinema and tech news, reviews, buying advice and deals, direct to your inbox.

Lewis Empson is a Senior Staff Writer on What Hi-Fi?. He was previously Gaming and Digital editor for Cardiff University's 'Quench Magazine', Lewis graduated in 2021 and has since worked on a selection of lifestyle magazines and regional newspapers. Outside of work, he enjoys gaming, gigs and regular cinema trips.