Best TV 2025: flagship OLEDs and budget LED sets tried and tested

The best TVs to pass through our test rooms that we can personally recommend

A new TV is one of the most exciting things you can spend your money on. At least, in our rather biased opinion.

Trouble is, there are hundreds of models out there, all vying for your attention by dazzling you with specs and carefully worded marketing spiel. And if you're committed to dropping some serious cash, you're going to want to spend your money wisely.

That's where we come in. Below, you will find a detailed round-up of what we believe to be the best TVs that money can currently buy.

No matter your budget or preference for Mini LED, OLED, or anything in between, you can rest assured that the models below have been hand-picked based on our thorough, in-depth review process.

We review TVs comparatively, seeing how they fare against our collection of reference models. It's all carried out in our dedicated test rooms, without any manufacturer influence. You can read more about our TV testing process at the bottom of this page, if you fancy.

Each TV below has been chosen for its ability to present an impressive, cinematically accurate picture, at least decent sound, and a great feature set, all while delivering exceptional value in the process.

We have a few new entries this month, including the Sony Bravia 8 II (our new premium pick), the Sharp 70GK4245K (the new best budget TV), and the Sony Bravia 7 (our new Mini LED recommendation).

While there are several budget recommendations below, do also peruse our guide to the best cheap TVs if your budget is limited. Bargain-hunters should also take a look at our round-up of the best TV deals.

The quick list

You can see a quick breakdown of all the TVs in this list with a summary of what they do well and why we think they’re worth your money in the table below.

If you want more detail on a certain model, click its image to go to the in-depth entry, where we offer a more comprehensive breakdown of the specs, features and real-world performance.

Best TV overall

It's close, but unless you're a hardcore gamer, the new Sony Bravia 8 is the best performance-per-pound TV currently available.

Best cheap TV

Amazon's Omni QLED range offers loads of features for a low price – and a surprisingly sophisticated performance, too. At full price, it's very good – when discounted, it's superb.

Best 42-inch TV / best gaming TV

The 42-inch LG C4 is the best all-round TV at its size and also an unbeatable gaming TV that combines great performance, specs and price.

Best 48-inch TV

The 48-inch version of the LG C4 can go slightly less bright than the larger models, but it's still comfortably the best TV of its size.

Best premium TV

Sony’s latest OLED delivers a dazzlingly bright, richly detailed and wonderfully three-dimensional picture — and it sounds mighty impressive too.

Load more

Best budget large TV UK

The Sharp 70GK4245K proves that massive screen sizes don't have to break the bank, delivering surprisingly competent picture quality and excellent smart features to boot.

Best budget large TV US

If you're a US buyer on a strict budget and still want a large, fully featured and competent TV, Amazon's Omni QLED is the way to go.

Best Mini LED TV

The Bravia 7 gets much closer to the quality of Sony’s Bravia 9 flagship than expected and is, as a result, one of the best mid-range TVs available

31st July 2025

We've removed the Sony A95L (Best Premium TV), TCL 65P755K (Best Budget TV) and Sony Bravia 9 (Best Mini LED TV) from the guide. They've been replaced by the Sony Bravia 8 II, Sharp 70GK4245K and Sony Bravia 7, respectively. All other entries and buying advice have been reviewed and refreshed to reflect our latest lab tests and recommendations.

I'm What Hi-Fi?'s TV and AV Editor, and I've been testing TVs and home cinema products (as well as hi-fi kit and headphones) for over 18 years. I've always been a massive TV nerd and got into reviewing so I could find the best TVs and recommend them to others. I firmly believe that great quality shouldn't cost a fortune, so I get just as excited about great-value sets as I do the flagship models. Overall, I'm looking for a picture performance that delivers movies and TV shows as intended, a great gaming experience, an app-packed and intuitive operating system, and good sound – though I also believe that any great TV should be combined with a great, dedicated sound system.

The best TVs in 2025

Why you can trust What Hi-Fi?

Below, you can see our picks of the best TVs currently available. Every set has been tested by our team of product experts to ensure it delivers great performance and value, so you can trust our buying advice.

Best TV overall

Specifications

Reasons to buy

Reasons to avoid

Released in 2023, Sony's A80L absolutely smashed the competition and ran away with a What H-Fi? Award, but we honestly didn't think its successor, the Bravia 8, would achieve the same feat.

That's because the LG C4, which we received for review earlier last year (and has of course now been succeeded by the LG C5, below), massively upped the ante with a consummate all-round performance that we just didn't think the Sony could beat.

Oh, how mistaken we were. The Bravia 8 might not be a huge step up on the A80L, but so good was that model that the small upgrades for its successor have ensured Sony has stayed on top.

The most valuable of these upgrades is to the colour balance. For all of its many strengths, the A80L had a slightly cool balance that made it look really crisp but lacking in cinematically authentic warmth.

That is not the case with the Bravia 8, which is richer and more accurate in tone, and therefore delivers movies closer to how the creator intended.

That's not the only improvement, either. Sony has managed to squeeze a little more brightness out of the 'standard' (as in not MLA or QD) OLED panel without sacrificing realism or black depth.

This increased contrast makes the picture look more exciting, but it also makes it look more solid and three-dimensional – a quality helped by Sony's clever processing, which very subtly sharpens foreground elements and softens the background.

Sony's Acoustic Surface Audio, which features actuators that imperceptibly vibrate the screen to make sound, not only ties the audio to the onscreen action in a way that standard TV sound systems can't match, it also manages to create a soundstage that stretches a surprisingly long way to the left, right and even above the screen.

A soundbar will still be a big upgrade, particularly in terms of bass weight and depth, but for a step-down TV, the Bravia 8 sounds very good indeed.

The Google TV operating system isn't quite as nice to use as the latest versions of LG's webOS or Hisense's VIDAA, but it's intuitive enough and packed to the rafters with streaming apps.

And while the TV has just two HDMI 2.1 sockets, which will be a frustration to hardcore gamers with multiple gaming machines (particularly those who want to use one of those sockets for an eARC sound system), the Bravia 8 is otherwise well-specced for gaming.

The Bravia 8 is about a year old now, but it is staying in Sony range throughout 2025.

It's also worth considering newer models such as the LG C5, Samsung S90F and Sony's own Bravia 8 II, but those are all currently very expensive.

That means the Bravia 8 remains the best performance-per-pound TV you can buy – for now.

Read the full Sony Bravia 8 review

Attributes | Notes | Rating |

|---|---|---|

Picture | Punchy, crisp and three-dimensional, with an authentic cinematic warmth that its predecessor lacked | ★★★★★ |

Sound | By step-down TV standards, the Bravia 8 sounds excellent, combining directness with spaciousness and loads of detail | ★★★★★ |

Features | Google TV features every app you could need and gaming specs are very good – though there are just two HDMI 2.1 sockets | ★★★★☆ |

Best new TV

Specifications

Reasons to buy

Reasons to avoid

LG's C-series models have long been the most popular OLED TVs in town, thanks to their combination of exceptional picture quality, uncompromised features and relatively accessible pricing.

Each year, the brand attempts to squeeze yet more performance out of what is essentially the same W-OLED technology. It's more successful some times than others – but for 2025's C5, it's been very successful indeed.

The claimed upgrades roughly amount to just a small increase in brightness and some new AI software features, but the improvements to real-world viewing are far more significant.

Getting a great picture is just as easy as before: select Filmmaker Mode and your preferred level of TruMotion processing (ours is Cinematic Movement), and you've immediately got a picture that's both authentic and dynamic.

The small amount of additional brightness makes the picture pop more than before, and colours are fabulously rich and vibrant, but the TV is still balanced and cinematically accurate.

Sharpness and solidity are much improved, too, and there's a three-dimensionality that gives even the Sony Bravia 8 a run for its money.

The feature set, as expected from an LG OLED, trumps that of any Sony model. That's thanks in part to the slicker webOS smart platform, but mostly because of the four HDMI 2.1 sockets, each of which supports 4K/144Hz (and 4K/120Hz) gaming with VRR and ALLM.

As with previous C-series models, Dolby Vision gaming is supported, too, and there's a peerless HGiG setting that makes it dead simple to get your HDR games looking excellent and accurate.

Sound quality is far less impressive. There's plenty of clarity and even some warmth to voices, so daytime TV is fine, but there's not enough weight, punch or dynamic range for a satisfying movie experience.

We generally don't mark TVs down for their audio quality as none sound very good so we always recommend adding a separate sound system, but if you are determined to live with your TV's built-in speakers, the Sony Bravia 8 is the better option.

The other major consideration to make before ordering an LG C5 concerns price. This is a brand new model, so it's still comparatively very expensive. It won't be long until it's heavily discounted, and if you can't wait, the Bravia 8 is the more sensible purchase right now.

Still, if you must buy now and must have a 2025 model, the LG C5 is the performance-per-pound champ.

Read the full LG C5 review

Attributes | Notes | Rating |

|---|---|---|

Picture | Excellently balanced and consistent, with great pop, vibrancy and three-dimensionality | ★★★★★ |

Sound | Clear and warm dialogue, but weight, punch and dynamics are lacking | ★★★☆☆ |

Features | webOS is slick and packed with properly optimised apps, and the flawless gaming specs include four HDMI 2.1 ports | ★★★★★ |

Best cheap TV

Specifications

Reasons to buy

Reasons to avoid

It’s fair to say that the standard of budget TVs has dropped significantly in recent years. Salvation is at hand, though, and from a slightly unlikely source – Amazon.

We first reviewed the 65-inch version of its Omni QLED range and discovered a TV with a surprisingly sophisticated performance to go with its surprisingly comprehensive feature set. It just missed out on five stars, but knowing how much variation there can be between different-sized versions of the ‘same’ TV, we decided to take a separate look at this 50-inch model – and we're glad we did.

This is a TV that's very good value at its full price of £650 / $530, but even so, you shouldn’t pay that much for it. That’s because it's frequently discounted by large amounts. We have seen it go as low as £400 / $350, but find it for anything under £500 / $500 and you've unearthed a bargain.

What makes the Omni QLED appear to be such a bargain is its specification, which includes a QLED panel with full-array local dimming, support for every current HDR format, gaming features such as VRR, ALLM and even Dolby Vision gaming, and the app-packed and user-friendly Fire OS operating system (which can be fully operated via Alexa, of course).

But what's most impressive about the Omni QLED is the considered and consistent nature of its performance. Too many budget TVs attempt to dazzle you despite not having the requisite ability, and they end up looking awful as a result.

The Omni QLED, on the other hand, works within its limitations; it's not going to knock your socks off but it gets all of the basics right and delivers a picture that's true to what the creator intended.

It’s natural in a way that means you don’t question the delivery and instead focus purely on what you are watching, and that’s a more impressive feat than you might imagine, particularly at this level.

On the sound front, the Omni QLED is a simple stereo affair, and all the better for it. Instead of attempting fancy processing, it simply provides a clean, clear and direct audio performance that's ideal for general TV content. You're advised to add a soundbar for movies, though.

Read the full Amazon Fire TV Omni QLED review

Attributes | Notes | Rating |

|---|---|---|

Picture | It's not up there with a flagship OLED, but for the money the picture is very impressive | ★★★★★ |

Sound | No fancy processing but the sound is clean, clear and direct | ★★★★☆ |

Features | QLED panel tech, numerous gaming features and an app-packed operating system | ★★★★☆ |

Whatever you do, don't buy the 43-inch version of the Amazon Omni QLED. Unlike the larger versions, the 43-inch model lacks local dimming, and Amazon doesn't appear to have tuned the picture to account for that. The result is a bright but pale picture with smeary motion.

Best gaming TV / best 42-inch TV

Specifications

Reasons to buy

Reasons to avoid

There was a time not that long ago when really good 42-inch TVs simply didn't exist. That changed when LG launched its first 42-inch OLED TVs, and the C4 is its best so far (at least until we've had a chance to review the equivalent C5). In fact, it's not only our favourite all-round 42-inch TV, but it's also the best gaming TV you can currently buy.

Despite being very similar on paper to the 42-inch C3, the C4 is a surprisingly effective upgrade with actual content. Smaller OLED TVs have always lacked the outright brightness of their larger siblings, but with the C4 models LG has closed the gap. The 42-inch C4 is beautifully punchy and dynamic, and the increased pixel density of the smaller display actually means it's even sharper than its bigger brothers.

The picture is really balanced, too, and easy to get the most out of. Pop it into Filmmaker Mode and you've instantly got an image that is fairly cinematically accurate and really enticing – though it is slightly cooler in balance than the larger models.

The webOS smart platform features far more ads than any TV operating system should, but it's also quick and intuitive, and it features the best selection of properly optimised streaming apps that you'll find anywhere.

For gaming, the 42-inch C4 is unbeatable. It's just about compact enough to work as a desktop-based gaming monitor, should you wish; it supports every gaming feature you might require (including 4K/144Hz, which its predecessor lacked); and it has four full-spec HDMI 2.1 sockets whereas most rivals have two at most.

The only real downside is poor audio, but that's par for the course with TVs this size. Accept that you will need to add a soundbar and the 42-inch C4 is a superb TV, whether you're a gamer or not.

Do bear in mind that the 42-inch C5 is available and should be even better, but we have not yet had the chance to review it and it's currently still full price, so vastly more expensive than this C4. For those reasons, we are still recommending the C4.

Read the full LG OLED42C4 review

Attributes | Notes | Rating |

|---|---|---|

Picture | Sharp, solid and detailed without exaggeration | ★★★★★ |

Sound | Weak, even by small TV standards | ★★★☆☆ |

Features | Great app selection and flawless gaming specs | ★★★★★ |

Best 48-inch TV

Specifications

Reasons to buy

Reasons to avoid

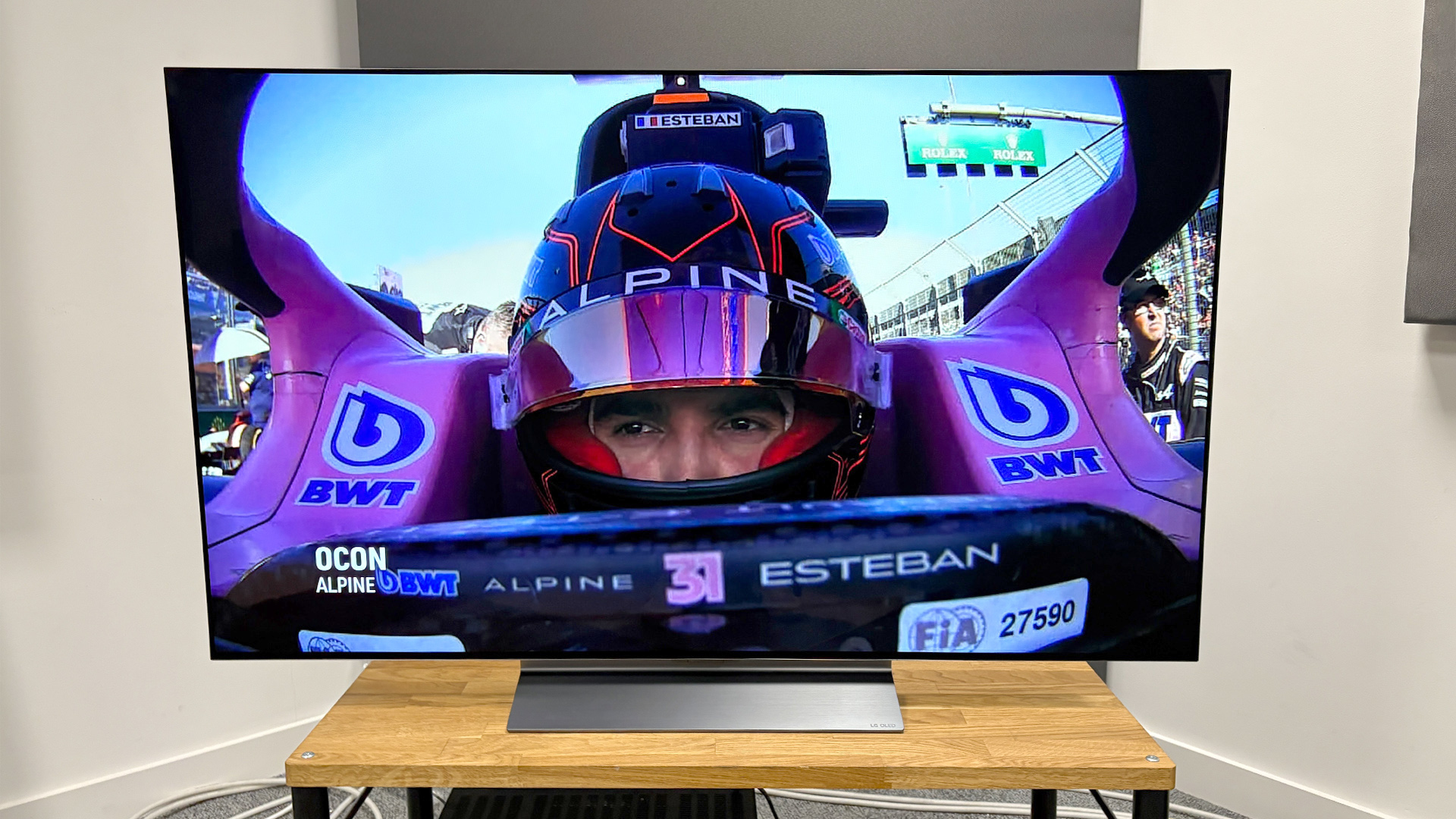

LG’s C5 might now be on the scene, but until we've had an opportunity to test the 48-inch model, there's no better intersection of performance, features and price at this size than the C4. That is why this TV sits in both this list and at the top of our guide to the best 50-inch TVs, which also covers 48-inch models.

The 48-inch C4 looks different to both the 42-inch and 65-inch models that we have also tested. While the 42-inch model has desktop-friendly feet, this 48-inch version has the same compact pedestal stand as its larger siblings. That makes it less fussy about placement but does also make it a little harder to find space for a soundbar.

And while the 65-inch model boasts an astonishingly lightweight and minimalist chassis, much more of this 48-inch version's rear is covered by the plastic enclosure that contains the set's processing hardware, connections and speakers. That said, the 48-inch C3 is still only 4.7cm (1.9") thick at its chunkiest, which is pretty slim by modern TV standards.

Moving on to features, you simply won't find a better-specified TV at this size. While neither MLA nor QD-OLED technology have made it below 55 inches yet, the C4 uses the best 48-inch OLED panel currently available from sister company LG Display. What's more, LG has significantly boosted the brightness of its smaller OLEDs, so while this 48-inch C4 is still not quite as bright its larger sibling, the difference is smaller than ever before.

All four of the C4's HDMI sockets are 48Gbps 2.1-spec affairs that support 4K/120Hz (4K/144Hz if you have a powerful enough gaming PC), VRR and ALLM, and it supports Dolby Vision gaming and has a really well-implemented HGiG setting that makes it a doddle to get more accurate HDR with many modern games.

Like the larger models, the 48-inch C4 represents a surprisingly big improvement on the C3 model it replaces. That additional brightness equates to increased contrast, and that has benefits right across the picture, with greater perceived sharpness and a big dose of extra punch and dynamism. There's still plenty of subtlety too, though, and the C4 is particularly good right out of the box, requiring very little intervention to get looking its best.

It produces an image that’s really solid and has a three-dimensional feel, too. In fact, the increased pixel density of having a 4K resolution squeezed into a 48-inch space means this smaller C4 looks significantly sharper than its 65-inch sibling.

The sound is fine for everyday TV, in that it's fairly clear and pretty natural with voices, but it struggles in terms of spaciousness and weight, so it's not great for movie nights. Adding a soundbar is vital if you're able.

There are very few TVs that sound good, though, so that is certainly not unique to LG. Follow that advice and the 48-inch C4 is comfortably the best TV at its size.

Read the full LG OLED48C4 review

Attributes | Notes | Rating |

|---|---|---|

Picture | Brighter display has benefits across the picture – this is the most impactful TV its size | ★★★★★ |

Sound | Fine for everyday TV but sadly lacking for movies | ★★★☆☆ |

Features | Four HDMI 2.1 sockets with every significant spec flawlessly implemented | ★★★★★ |

Best premium TV

Specifications

Reasons to buy

Reasons to avoid

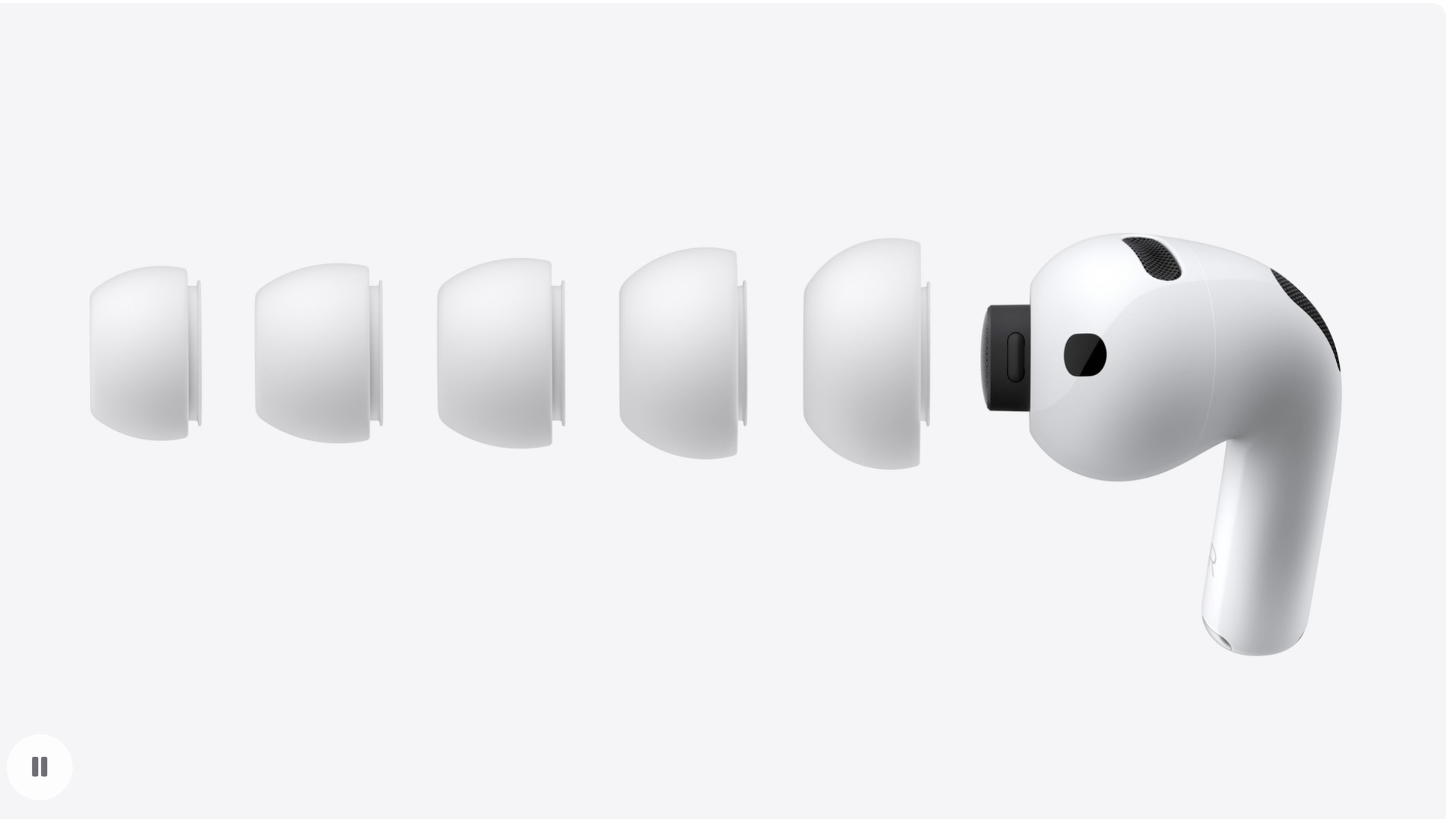

The Sony Bravia 8 II is the successor to the five-star Sony A95L QD-OLED, a model that remains among the very best TVs available, despite being nearly two years old.

Sony has equipped this new model with its latest QD-OLED panel, claiming it delivers 25 per cent more peak brightness than the A95L, and 50 per cent more than the standard Bravia 8.

During extensive testing against both the A95L and Bravia 8, the improvements proved immediately apparent. Peak highlights display noticeably brighter intensity, with pin-prick stars glistening more piercingly against deep space backgrounds.

Bright colours also maintain exceptional vibrancy across all lighting conditions, while Sony's enhanced dark gradation work reveals shadow details that were lost on both comparison models. Folds and wrinkles in clothing, subtle facial expressions, and fine textures emerge clearly where the other sets miss these elements entirely.

The enhanced brightness combines with improved colour reproduction and superior shadow detail through Sony's XR Processor, which features a new AI scene recognition system, creating images with remarkable solidity and three-dimensional presence.

Dramatic sunrise skies appear to stretch toward the horizon with greater depth and contrast, while animated content crackles with colourful energy that maintains natural authenticity.

Getting this exceptional performance also requires minimal effort. Our testing found that simply selecting Dolby Vision Dark for Dolby Vision content or Professional mode for everything else delivers delightfully authentic results. For extra excitement, Dolby Vision Bright or Cinema modes add impact without sacrificing much in the way of accuracy. The presets proved so well-calibrated that most users won't need additional adjustments.

Direct testing with content including Alien: Romulus, Sinners, Into The Spider-Verse, and Pan demonstrated the Bravia 8 II's advantages across all material types. Impressively, we noted that bright HDR content, such as Pan, which is mastered to 4000 nits, showcased the TV's exceptional tone mapping and highlight handling. Even standard-definition content from The Thin Blue Line displayed impressively clean upscaling with notable sharpness and detail improvements.

On the sound front, Sony's Acoustic Surface Audio+ system uses the same configuration as the A95L, with two actuators vibrating the screen itself for sound reproduction, with two subwoofers providing bass support.

This creates spatial audio that ties directly to visual action while extending beyond the screen's boundaries. Our review noted excellent detail retrieval, convincing dynamic range, and natural tonal balance throughout, ranking it among the very best built-in TV sound systems available. No mean feat, but we still recommend adding a dedicated soundbar.

Elsewhere, gaming capabilities include 4K/120Hz, VRR, ALLM, and a Dolby Vision Game mode, plus "Perfect for PlayStation 5" functionality that automatically optimises HDR settings when connected to Sony's console. However, the limitation of just two full-bandwidth HDMI 2.1 sockets continues, with one doubling as the eARC port.

As for the design, it largely carries over from the A95L, with blade-style feet that must be positioned at the TV's extremes. While this prevents placement on narrow furniture, the feet can be extended to accommodate a soundbar underneath. The remote control represents a downgrade, though, losing the rechargeable, backlit functionality of its predecessor for a basic AAA battery-powered version.

Overall, the Bravia 8 II is a significant upgrade across all areas, making even the excellent A95L appear somewhat flat in direct comparison.

The combination of enhanced brightness, superior shadow detail, and refined AI processing creates images with astonishing dynamism and realism, representing an impressive advancement in OLED tech.

For those seeking exceptional picture quality with minimal setup effort and outstanding built-in sound, the Bravia 8 II won't disappoint.

Read the full Sony Bravia 8 II review

Attributes | Notes | Rating |

|---|---|---|

Picture | Transformative brightness, vibrant colours, and exceptional shadow detail create astonishingly realistic images | ★★★★★ |

Sound | Sony's Acoustic Surface Audio+ delivers spatial, detailed sound that ranks among the best available | ★★★★★ |

Features | Excellent gaming specs and apps, but limited HDMI 2.1 sockets may disappoint | ★★★★☆ |

Best budget large TV UK

Specifications

Reasons to buy

Reasons to avoid

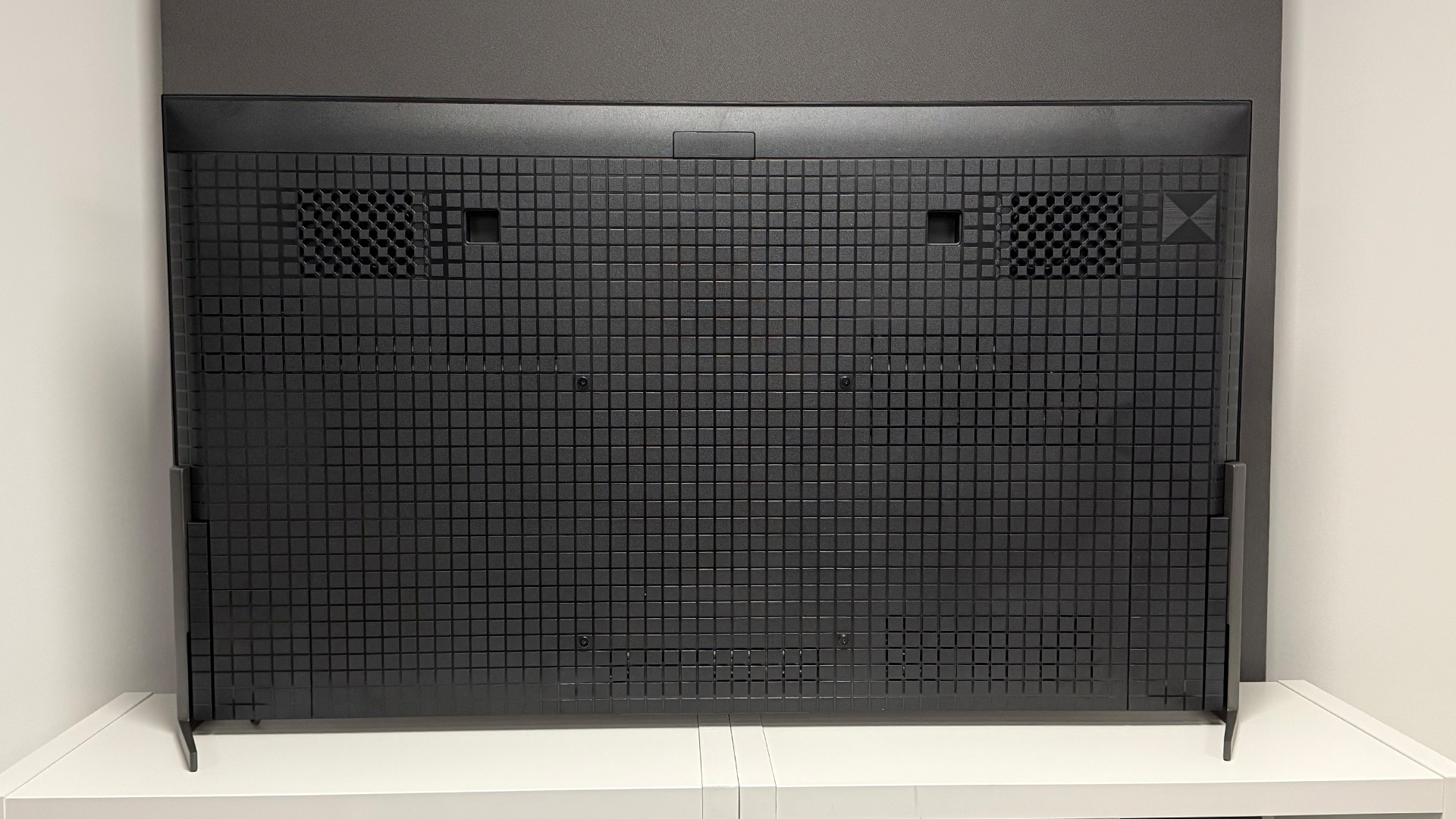

The Sharp 70GK4245K serves up a more than generous 70-inch screen that costs just £489. At this price point, we'd normally expect significant compromises that render a TV barely watchable, but Sharp has managed to deliver something rather surprising here.

The most striking aspect isn't just the sheer size-to-price ratio, but how the 70GK4245K manages to deliver a cohesive viewing experience despite its budget constraints. The VA-type LCD panel provides substantially brighter pictures than we anticipate from ultra-affordable TVs, with HDR content displaying crisp, punchy highlights and respectable sustained brightness across full-screen bright shots.

While you're not witnessing the full range and impact of HDR's light capabilities, there's enough brightness to help pictures look reasonably natural and engaging, rather than the dull compromise you'd typically expect at this price point.

Perhaps more impressive, though, is how this healthy brightness doesn't come at the expense of dark scene performance. The amount of greyness creeping into areas that should appear black remains surprisingly minimal despite the lack of local dimming. Shadow detail remains abundantly present in even the darkest corners when avoiding the Dolby Vision Dark setting, helping create a much more consistent viewing experience than expected from such an affordable large-screen TV.

The picture quality continues to impress with surprisingly sharp and clean imagery. The screen handles even subtle colour blends and tonal shifts without the striping, blocking, or clumping typically associated with budget displays.

While there's no wide colour gamut coverage or Quantum Dot technology, colours remain consistently balanced with no aggressive blue or green wash hanging over proceedings. Motion handling proves competent too, with some blur during fast movement but without descending into actual smearing or lag.

The display's main weakness comes in the form of backlight clouding, with light creeping into dark scenes mostly at the screen edges, but also in some central spots. These light pools disappear completely during bright footage, but can prove distracting enough during very dark sequences to impact the viewing experience. This represents the main compromise preventing the 70GK4245K from achieving budget picture perfection.

The sound performance struggles to match the picture quality achievements as well. Audio feels trapped within the TV's bodywork even at full volume, leaving action scenes and dense musical scores sounding swallowed and thin.

The detached dialogue presentation and minimal bass presence highlight the limitations, though the system operates within its constraints without producing distortion or harshness.

Sharp has also equipped the 70GK4245K with features that punch well above its price class. The TiVO smart system runs as slickly and stably as any premium implementation, carrying an impressive array of apps including Netflix, Disney+, Prime Video, BBC iPlayer, ITVX, All4, My5, and the new Freely platform for live-streaming Freeview channels. The only notable absence is Apple TV+, though this can be accessed through Prime Video (albeit with slightly reduced quality).

Gaming capabilities include some pleasant surprises, with 120Hz support at 1080p resolution, plus VRR and ALLM. While 4K gaming tops out at 60Hz, Dolby Vision gaming is supported, and input lag measures an impressive 14.8ms in Game mode.

The build quality reflects the budget positioning, but the notably flimsy construction at least makes the TV surprisingly easy to move. The rear section is fairly chunky by modern standards, making wall mounting cumbersome, while the desktop feet must be positioned at the extreme corners, requiring furniture nearly as wide as the 70-inch screen itself.

Still, at this price, the Sharp 70GK4245K delivers an overall level of picture quality that has no business appearing on such an affordable home cinema-sized TV.

While backlight clouding and uninspiring audio represent clear compromises, the excellent TiVO smart system and surprisingly competent picture performance make these limitations remarkably easy to accept.

Read our full Sharp 70GK4245K review

Attributes | Notes | Rating |

|---|---|---|

Picture | Surprisingly bright and balanced for the price, with solid contrast and clean motion handling. But backlight clouding undermines dark scenes | ★★★★☆ |

Sound | Audio feels trapped within the chassis with minimal bass and detached dialogue, though it avoids distortion | ★★★☆☆ |

Features | Excellent TiVO smart system with comprehensive apps, plus decent gaming specs and premium calibration options | ★★★★☆ |

Best budget large TV US

Specifications

Reasons to buy

Reasons to avoid

If you're in the USA, our favourite budget large-screen TV is Amazon's 65-inch Omni QLED.

You won't be surprised to learn that while this is a flagship product for Amazon, it’s still very much a value-oriented proposition. What might surprise you is how much of an all-rounder it is, delivering a very solid picture and sound performance and a very good feature set for the money.

This isn’t a performance in the same league as that offered by flagship sets from the big boys, of course, but the quality and balance that have been achieved at this level are very impressive.

Colours are vibrant and punchy when they need to be but subtle and pale when that is what’s called for. Skin tones at times look just a little richer than is perhaps entirely true to life, but only marginally so, and they certainly don’t look unnatural when viewing the TV in isolation.

A common problem with affordable TVs is that they attempt to dazzle you without having the hardware or processing quality to back it up, and that often actually highlights the limitations of the set. That's not the case with the Omni QLED, which takes a more considered approach across the board, resulting in an overall performance that's less striking than some but much more natural and consistent than most. This balanced approach means you're rarely if ever distracted by what the TV is doing and so can remain fully engrossed in what you're watching.

Inevitably, Amazon’s Omni QLED isn’t perfect. It doesn’t have the pure peak brightness to provide a dazzling rendition of the latest and greatest HDR movies, but that’s understandable at this level. However, while detail levels are decent, they could be better, particularly in darker images, even at this price.

Motion is a slight issue, too. If you avoid the heavier active processing options (which you should), there's no soap opera effect or unpleasant fizziness, but motion is a bit smeary. This is a common issue with affordable non-OLED TVs and the Omni QLED is better than most in this regard, but it's a shame that it is present at all.

Amazon has kept things simple on the audio front, avoiding the temptation to attempt fancy Dolby Atmos processing and the like, and once again we feel that is a wise decision. Yes, the sound is narrow and small in scale compared with that offered by more premium TVs – and there is no attempt to push sound outwards to the sides or up from the television’s chassis – but it is also direct and clear.

On the features front, you're getting a 4K QLED display with the app-packed and user-friendly Fire OS operating system with baked-in Alexa control (you can turn the TV's mics off entirely if you prefer). Somewhat surprisingly, VRR and ALLM are also supported, though 4K 120Hz is off the menu.

All told, by getting the basics right in terms of picture and sound quality while providing an impressive feature set for the price, the Omni QLED makes itself an easy TV to recommend to US buyers on a tight budget.

Read our full Amazon Fire TV Omni QLED review

Attributes | Notes | Rating |

|---|---|---|

Picture | You don't get OLEDs deep blacks, but great for the price | ★★★★☆ |

Sound | A soundbar is recommended, but it's fine for TV | ★★★★☆ |

Features | Great connectivity and an app rich operating system | ★★★★☆ |

Best 8K TV

Specifications

Reasons to buy

Reasons to avoid

The wait for actual, real, worthwhile 8K content continues, but the QN900D proves that there is still some value in buying an 8K TV if you have the money for it. That's because it uses next-level AI-enhanced upscaling to make everything you watch now look better than before.

During our extensive testing, all of the 4K content we watched looked sharper and more detailed through the QN900D than with any TV we've previously tested. This isn't 'real' detail, per se, because the TV is adding the extra picture information, but it does it in such a way that's entirely convincing and never looks unnatural. On the contrary, it's often the organic elements of a picture – trees and grass, for example – that benefit most readily from the QN900D's enhancements, coming across as more solid and more three-dimensional.

The QN900D is extremely capable in other ways, too. Its Mini LED backlight is one of the best we've seen, for starters, and as long as you stick to the excellent 'Movie' preset it delivers near-OLED blacks, hugely bright highlights and superb overall contrast. Its Quantum Dots enable stunning colour vibrancy, too, but Samsung has also been careful to tune the QN900D for naturalism and cinematic accuracy.

This combination of picture traits helps to make the QN900D an exceptional gaming TV, and its input lag is a super-low 11ms even with all of that clever upscaling in play. The set also has four HDMI 2.1 sockets, all of which support 4K/120Hz, VRR and ALLM.

Those HDMIs, along with the TV's other connections (including the power socket), are housed in a dedicated One Connect box that can be nestled into the stand behind the TV or placed away from it, with a single, very thin cable then connecting box to screen. This makes for an exceptionally neat set-up, particularly if wall-mounting. It also allows the TV itself to be supremely thin – a uniform 1.3cm (0.5 inches).

The downside to this super-thin design is that it likely hinders the sound, which lacks volume, impact, forward projection and bass control. A TV such as this really must be combined with a dedicated sound system.

Other issues of note are some distracting behaviour from the backlight when in the 'Standard' picture preset, a lack of Dolby Vision support, some unintuitive elements to the Tizen operating system and, of course, that lack of native 8K content. It's also a very expensive set, although the price has fallen by more than £2500 since launch.

Ultimately, while we think buying a great 4K TV is still the best way to go for the vast majority of people, for those with deep pockets and a desire to both glimpse the 8K future and potentially be ready for it once it fully arrives, the QN900D has to be considered.

Just keep in mind that the replacement model, the QN990F, will soon be available in shops, though it will be at full price for quite a while.

Read our full Samsung QN900D review

Attributes | Notes | Rating |

|---|---|---|

Picture | A stunning delivery that makes everything look sharper, more detailed and punchier than ever before | ★★★★★ |

Sound | Spacious but lacking volume, forward-projection and bass control. A dedicated sound system is essential | ★★★☆☆ |

Features | The lack of Dolby Vision is a shame, but otherwise the QN900D is very well appointed, and all connections are housed in the super-neat One Connect box | ★★★★★ |

Best Mini LED TV

Specifications

Reasons to buy

Reasons to avoid

What makes the mid-range Bravia 7 particularly compelling is how much of Sony's groundbreaking backlight technology from the premium Bravia 9 has filtered down to create what may be the best value proposition in Sony's current range.

At the heart of the Bravia 7's appeal lies its Sony XR Backlight Master Drive system, which combines Mini LED lighting with local dimming across more than 300 separate zones in the 55-inch model we tested.

As a result, the most striking aspect of the Bravia 7's picture performance is its ability to maintain both exceptional brightness and convincing blacks simultaneously. HDR whites and colours blaze from the screen with intensity that rivals much more expensive flagship models, while dark areas achieve startlingly deep, OLED-like blacks.

More importantly, the TV doesn't deliver these extremes in isolation – the backlight controls prove astute enough to retain most of the brightness in highlights and black depth in dark areas, even with mixed-brightness content that makes up the majority of what we actually watch.

This consistency across varied content creates a remarkably immersive viewing experience where nothing the TV does throws you out of what you're watching.

The Bravia 7 brings out detail in even the darkest picture corners, with only minor black crush in the Movie preset. More impressively, blooming around bright objects remains exceptionally well-controlled – the black bars above and below widescreen films stay almost completely free of greyness or blooming artefacts, even when bright objects appear right alongside them.

Sony's XR Triluminos Pro system leverages this excellent light control to deliver a wide, vibrant colour range that maintains natural refinement. The TV retains full saturation in very dark picture areas while bringing out subtle light differences in very bright areas that elude most competitors in its class. This superb light and colour control unlocks exceptional sharpness and detail with native 4K content, delivered without exaggerated grain or glowing edge artefacts from heavy-handed processing.

The only notable limitations emerge with particularly complex shots containing scattered extreme light and dark elements, where slight general clouding and occasional blue colour shifts can appear. Backlight blooming also becomes more noticeable from wider viewing angles. However, these represent minor compromises in what otherwise delivers exceptional consistency and immersion.

Gaming capabilities prove equally impressive. Input lag measures 17.9ms in Game mode – slightly higher than some Sony models, but not enough to affect anyone except the most competitive gamers. The TV supports 4K/120Hz, VRR, ALLM, and low-latency Dolby Vision gaming across two of its four HDMI ports, plus Perfect For PlayStation 5 compatibility for automatic HDR optimisation.

As for its design, the included feet can be configured in four different positions – wide or narrow placement, low or raised height – allowing placement on narrower furniture or accommodation of soundbars underneath. The flush-mounted screen and frame create an immediately premium impression, while the remote control features a tactile, stripped-back button design.

When it comes to sound, Sony's Acoustic Multi-Audio system delivers 40W of power through four speakers comprising two full-range bass reflex drivers and two tweeters. While not matching the picture excellence, the sound creates a nicely projecting soundstage that extends beyond the TV's physical chassis, populated with clean, well-positioned details that do reasonable justice to Dolby Atmos and DTS:X mixes. Dialogue emerges with conviction and clarity, though the most explosive action moments can feel slightly polite and trebly with limited bass heft.

Google TV provides the smart platform foundation, enhanced in the UK by YouView for terrestrial catch-up services. The usual extensive app selection includes calibrated modes for Netflix, Prime Video, and Sony Pictures Core, plus IMAX Enhanced certification for specially mastered content. Sony's commitment to third-party endorsements continues with Dolby Vision and Atmos support, though HDR10+ remains absent, as is typical for Sony models.

The Bravia 7 delivers a distilled version of Sony's flagship backlight mastery – not quite as explosive as the Bravia 9, but actually more consistent in its delivery, resulting in what may be the finest mid-range LCD television we're likely to encounter this year.

Read our full Sony Bravia 7 review

Attributes | Notes | Rating |

|---|---|---|

Picture | Outstanding backlight control delivers exceptional brightness and OLED-like blacks simultaneously, with superb colour accuracy and minimal blooming | ★★★★★ |

Sound | Clean, well-positioned audio with good soundstage projection, though lacks bass heft during explosive moments | ★★★★☆ |

Features | Comprehensive gaming specs and Google TV platform, but limited to two HDMI 2.1 ports | ★★★★☆ |

Also consider

LG G5

LG's flagship 4K TV for 2025 features brand new Primary RGB Tandem OLED technology in place of the G4's MLA tech. It's a really big step forward, particularly in terms of full-screen brightness and colour reproduction, and the G4's stylish design and excellent feature set remain. Ultimately, we feel the Bravia 8 II is the better all-rounder, but the G5 is well worth considering, particularly if you're a big gamer.

Panasonic Z95A

The Z95A was Panasonic's flagship TV for 2024. It combines brightness-boosting MLA OLED technology with the brand's trademark 'as the director intended' approach to picture quality to great effect. It also has an advanced audio system with dedicated side- and up-firing speakers, good gaming specs and the app-packed Fire TV operating system. Bear in mind that the Z95A's replacement, the Z95B, is also now on sale.

Samsung Q80D

If you're looking for a mid-range TV that punches above its price, the Samsung Q80D has to be on your shortlist. It lacks the Mini LED technology of its more expensive siblings, but it uses its standard QLED technology to produce a sharp, punchy and always-enjoyable picture. It's got great gaming specs, too, including four HDMI 2.1 sockets that support 4K/120Hz, VRR and ALLM.

Philips OLED809

The Philips OLED809 is a really strong alternative to the LG C4 and Sony Bravia 8 if you're in the UK (Philips doesn't sell OLED TVs in the US or Australia). Like those TVs, it uses a 'standard' OLED panel, but it delivers a particularly bright and vibrant picture. It's got Ambilight, too, which adds an extra degree of spectacle. It does take more effort than most to get the picture looking its best, though.

Samsung S95D

Samsung's third-generation QD-OLED TV is an absolutely stunning performer that combines the pop and vibrancy we've come to expect from the brand with a welcome dose of restraint. The newer S95F is also now on sale, but we haven't yet been able to review it.

How to choose a TV

There’s no single TV that’s perfect for everyone, but your ideal TV is almost certainly on this page. You just need to figure out your budget, how big you want to go, and what technologies are important to you.

Budget and space

Only you will know how much budget and space you have to use, although you will find a handy guide to choosing the right size of TV further down this page.

Panel technology

The next thing to consider is the panel technology. OLED now rules the roost at the premium end of things and is hugely popular thanks to its perfect blacks and pixel-level contrast control. LCD is still a huge deal too, though, particularly at the budget end of the market that OLED currently can’t touch. There are plenty of premium LCD-based TVs that are great, too, most notably Samsung’s top QLEDs, which combine Quantum Dots with Mini LED backlights to deliver the brightest, most vibrant pictures possible. There's also Micro Lens Array (MLA) technology, which uses a layer of microscopic lenses on top of the OLED pixels to achieve even more dazzling levels of brightness.

Streaming apps

Also, consider whether the TV you’re looking at has all of the streaming apps you want. While some apps, such as Netflix and Prime Video, are now commonplace, there may be an app that you love that’s less common. The Crunchyroll anime app is a good example. It’s also sadly the case that some streaming apps don’t work as they should on certain TVs. For example, many Google/Android TVs support Disney+, but not with Dolby Atmos. That’s why we manually check not only that every major app is present, but that it’s working at its best.

Gaming features

Serious gamers also need to check that their prospective new TV supports all of the latest gaming features. The most technically advanced and therefore rarest of these is 4K/120Hz, which is supported by the PS5, Xbox Series X and advanced gaming PCs, and results in a more responsive gaming experience. Bit also look out for VRR (which reduces stutter in games) and ALLM (which automatically switches the TV to its game mode when you load one up), both of which are very much worth having. There are a number of TVs on this list that support all of these features, but we have a dedicated best gaming TVs guide for those to whom gaming is the primary concern.

Sound

Finally, you need to consider sound, but that doesn’t mean you should dismiss a TV just because it doesn’t sound good. The disappointing truth is that even the best-sounding TV is far behind a decent soundbar for audio quality, so we always recommend focusing on picture quality when buying a TV and budgeting for a dedicated sound system to go with it. We know that’s not an option for everyone, though, so we do of course test a TV’s speakers as thoroughly as its screen. If the audio quality matters a lot to you, you’ll find all the necessary info below. There’s also a TV in this list that’s serious about Dolby Atmos sound.

How we test TVs

A modern TV is a complex, all-singing, all-dancing bit of kit, so we take days to thoroughly test each model.

The bulk of our testing involves feeding various movies and TV shows into the TV on test and its closest rivals (we have a stockroom full of reference models) simultaneously, using a 4K Blu-ray player such as the Pioneer UDP-LX500 and an HDMI splitter. Here, we're testing all aspects of picture quality using DVDs, 1080p Blu-rays and 4K Blu-rays, in both HDR and SDR.

We don't simply accept a TV's out-of-the-box settings, of course. We don't go down the route of professionally calibrating the TVs we test (you shouldn't have to have your TV professionally calibrated to experience its full potential) but we do spend hours testing and adjusting the picture settings and processing modes – using a mix of test patterns and real-world content – until we're confident that we're getting the best performance possible.

We test streaming as well – both in terms of how the TV handles streamed content, which is lower in bit-rate than content from discs, and the streaming apps that the TV natively supports. We manually check that every major app – from Netflix to All 4, Prime Video to Spotify – is not only present but also output in the video and sound formats that it should. Just because a specific app is present doesn't mean it's delivering in all the formats (Dolby Vision and/or Atmos, for example) that it advertises. Experience tells us that it often isn't.

For gaming, we connect both a PS5 and Xbox Series X so we can see how the TV's qualities translate to games and check which advanced gaming features it supports and on which HDMI inputs. Is 4K/120Hz supported? How about VRR? Is there a Dolby Vision game mode? Is there an HGiG preset for more accurate HDR tone mapping? We check all these things and measure input lag using a Leo Bodnar device.

We almost always recommend combining any new TV with a dedicated sound system – at least a soundbar but preferably an AV amplifier and speaker package – but we appreciate that for many people that simply won't do, so we do of course test and rate the built-in sound system for clarity, tonal balance, spaciousness, detail, dynamics and plenty more besides.

All of this testing is conducted by our expert reviewers, who have decades of combined TV reviewing experience, in our state-of-the-art testing facilities in London. This gives us complete control over the testing process, and because all reviews are conducted by a team rather than an individual reviewer, we ensure consistency and fairness.

TV FAQ

What size TV should you buy?

While it might be tempting to think that bigger is better, the size of set that’s right for you is dependent on how close to the screen you’ll be sitting, and the resolution of the source material you’re watching.

Luckily, an organisation called the Society of Motion Picture and Television Engineers (SMPTE) has published detailed guidelines on exactly how far you should sit in order to optimise the performance of your TV.

If you’re sitting the correct distance from your TV, you’ll see lots of detail, good edge definition and smooth, clean motion, but if you’re sitting too close to the screen, then you’re going to see more picture noise and artefacts.

On the other hand, sit too far away from the TV and you’ll struggle to pick up all the picture detail your TV has to offer.

The following distances are a good place to start:

42-inch TV – 1.28m (4.2ft)

43-inch TV – 1.32m (4.3ft)

48-inch TV – 1.46m (4.8ft)

50-inch TV – 1.52m (5ft)

55-inch TV – 1.68m (5.5ft)

65-inch TV – 1.98m (6.5ft)

75-inch TV – 2.29m (7.5ft)

85-inch TV – 2.59m (8.5ft)

Here's a full guide on how to calculate the right viewing distance for your TV.

Should you buy a 4K or Full HD TV?

This question is pretty much moot now, as the vast majority of TVs are now 4K. It's actually rather hard to find Full HD (1080p) models, even at relatively small sizes.

If you're buying a TV below 32 inches and can save a lot of money on a Full HD model, by all means go for it (4K won't be a huge benefit at that sort of size anyway), but otherwise 4K is both worthwhile and, in all likelihood, your only option. Here's how 4K vs 1080p resolutions differ.

Should you buy an 8K TV?

You can now buy 8K TVs from a number of brands, including Samsung, LG and Sony. It's important to note, though, that almost no native 8K content is available. If you buy one of the best 8K TVs now and want to show off its ridiculously high resolution, you'll have to do so using nature, scenery and space footage from YouTube. At this stage, no streaming services have even hinted at launching 8K content, and it seems unlikely that an 8K disc format will ever materialise.

For those reasons, it's hard to recommend that most people pay the extra for an 8K TV at this stage. That said, if you've got deep pockets and want to be as ready as possible for the potential 8K content of the future, there's no real harm in going for an 8K TV now, particularly as models such as the Samsung QN900B make current 4K content look better than ever.

Should you buy an HDR TV?

High Dynamic Range is without a doubt a much bigger deal than 8K, and certainly something you should consider before buying your next TV.

Essentially, the higher the dynamic range (brightness and colours), the more lifelike the picture. HDR offers greater subtlety and depth of gradations of colours, plus stronger contrast.

There are various types of HDR out there, and with different TV brands backing different variants, it can be a minefield trying to find the best option. Allow us to explain.

First up is HDR10, which is essentially the core HDR format that every HDR TV should support.

HDR10 is a static HDR format that applies the HDR values on a scene-by-scene basis (i.e. whenever the camera cuts to a new scene). Dolby Vision, on the other hand, applies this image information (called metadata) on a frame-by-frame basis. This dynamic form of HDR, when implemented properly, has the potential to improve upon the standard HDR10 presentation.

HDR10+ is a rival format to Dolby Vision. Created by Samsung, it also uses dynamic metadata but, whereas Dolby Vision is licensed, HDR10+ is a free, open format that any company can deploy as it sees fit.

Of these two 'dynamic' HDR formats, Dolby Vision is by far the most prevalent, both in terms of TVs and content, and if you have to choose between one and the other, that's the one we'd recommend. That said, you can now buy TVs from the likes of Philips and Panasonic that support both Dolby Vision and HDR10+.

Finally in our rundown of HDR formats is HLG (Hybrid Log Gamma), which was developed specifically for broadcasting by the BBC and Japan's NHK. It's used to deliver all of the HDR content offered by the BBC and Sky, so can be considered very important. Luckily, it's now almost as common as standard HDR10 in TV spec lists, so you should have little problem finding a model that supports it.

What inputs and outputs does your TV need?

These days, it's all about HDMI, which is used to connect everything from set-top boxes to video streamers, Blu-ray players to games consoles. Thanks to ARC/eARC (Audio Return Channel / Enhanced Audio Return Channel), a single HDMI connection can even be used to output sound to an AV receiver or soundbar at the same time as it receives a video signal.

Currently, three HDMI connections is standard on budget TVs, while four is the norm for mid-range and premium models.

The specification of the HDMI connections tends to differ depending on the price of the TV, too, with premium models now commonly getting at least one or two HDMI 2.1 sockets. These have greater bandwidth than their HDMI 2.0 counterparts and can support advanced formats such as 4K@120Hz and 8K@60Hz. Fancy gaming features such as Auto Low Latency Mode and Variable Refresh Rate are often supported via HDMI 2.1 (and some HDMI 2.0) sockets, too, though not always. It's sensible to check the specs thoroughly if there are particular features you're after.

After HDMIs, USB ports are the most abundant on modern TVs. You can use these to keep devices charged (often particularly useful for stick- or dongle-style streamers), and some TVs allow the connection of flash drives and hard drives for the recording of live TV content.

On the subject of live TV, you can expect practically every TV to have an aerial socket via which it can receive Freeview broadcasts, but many also have a satellite connection. Be warned, though; the presence of a satellite connection doesn't guarantee that there's a Freesat tuner on board. Without one, you'll receive only a patchy and disorganised selection of satellite TV channels.

Other useful connections include optical and stereo outputs, which can be used in lieu of HDMI ARC to connect legacy audio equipment. Headphone outputs are still fairly common, too, though Bluetooth is also supported by most TVs now and some models now feature the latter but not the former.

Lastly, while some TVs feature composite inputs (often via an adapter), most – even at the budget end – have phased out legacy connections such as SCART. So those clinging on to old video cassette recorders, for example, should be aware of that.

Which TV smart features and streaming apps do you need?

As with 4K, it's now hard to buy a TV that doesn't have a smart platform packed with streaming apps. Almost every TV will have Netflix and Amazon Prime Video on board, and Disney+ is fast approaching a similar level of ubiquity. Apple TV (which is great for pay-as-you-go movies as well as the Apple TV+ subscription service) is becoming increasingly common, too.

You'd have thought that BBC iPlayer, ITV Player, All 4 and My5 would be present on every TV available in the UK, but there always seems to be one brand that's lacking (it was LG in 2020, Sony in 2021, Sony again and Philips in 2023) so do check before you buy if any of those are important to you.

Other apps that are less common but potentially worth looking out for include BT Sport, Now, Britbox, and music apps such as Spotify and Tidal.

What is the best smart TV platform?

There are numerous TV operating systems out there, and which one your TV uses has a massive bearing on what it will be like to use and live with, so which is best?

While there's not necessarily a simple answer to this and each platform has its pros and cons, on balance, LG's webOS is probably the best TV operating system right now. Its selection of streaming services is more or less flawless, and every app has been optimised to work at its best. It's quick and intuitive, too.

Samsung's Tizen platform used to be the best but it's become increasingly convoluted and unintuitive in recent years. Hisense's VIDAA operating system, on the other hand, is getting better all the time and should now be seen as a positive feature.

Unlike the above, Google TV (and the older Android TV) is built into TVs from various brands, including Sony, Philips and TCL. It's broadly good and always getting better, but recent Google TVs have lacked UK catch-up apps and there's often a slightly disjointed overall user experience, with the Google TV OS feeling as if it's been slapped rather unceremoniously on top of the TV's own menu system.

Amazon's Fire OS platform, which many will have experienced via a Fire Stick streamer, is also now on various TVs, mostly at the cheaper end but also Panasonic's flagship OLED model. It pushes Amazon's own content a bit, but every third-party app you could want is there and the whole platform is very user-friendly.

Should you buy an OLED, QLED or LCD TV?

LCD TVs, which require a backlight usually made up of white LEDs to show a picture on the LCD panel, are available in a wide variety of screen sizes and, thanks in part to the technology's low cost of production, at affordable prices.

OLED (Organic Light-Emitting Diode) is a panel technology that uses self-emissive particles – so there's no need for a backlight. This allows OLED TVs to be unbelievably slim, while also offering convincing pitch-dark blacks, strong contrast and superb viewing angles. LG, Sony, Panasonic, Philips and now Samsung are the big brands with OLED TVs in their line-ups and, broadly speaking, they're excellent.

QLED (Quantum-dot Light-Emitting Diode), meanwhile, is Samsung’s rival technology to OLED. A QLED TV is an LCD TV but with a quantum dot coating over the backlight. However, the quantum dots (tiny semiconductor particles) in current QLEDs do not emit their own light. So QLED TVs, like conventional LCDs, rely on a backlight. The advantages of a QLED TV? You tend to get brilliantly vibrant colours, plus bright, sharp and crisply detailed images.

Samsung's QLEDs have got better and better over the years, existing as a fine alternative to OLEDs TVs. Interestingly, though, Samsung has now launched its own range of OLED (QD-OLED) TVs.

Recent updates

29th July 2025

We've removed the Sony A95L (Best premium TV), TCL 65P755K (Best budget TV), and Sony Bravia 9 (Best Mini LED TV) from the guide. They've been replaced by the Sony Bravia 8 II, Sharp 70GK4245K, and Sony Bravia 7, respectively. All other entries and buying advice have been reviewed and refreshed to reflect our latest lab tests and recommendations.

30th April 2025

Added the LG C5 as the 'best new TV', and added the LG G5 and Sony Bravia 7 to the 'also consider' section. All other entries and advice sections have been checked and updated to reflect our latest buying advice.

13th March 2025

Upgrades to the Sony Bravia 9 mean it has been promoted to our choice of Best Mini LED, while the newly reviewed LG C5 has been added to the also consider section.

27th November 2024

Removed the LG Z3 from the also consider section and added the Panasonic Z95A and Samsung Q80D.

29th October 2024

Replaced the LG C4 with the Sony Bravia 8 as the best TV overall after side-by-side comparisons conducted for the What Hi-Fi? Awards 2024. Also replaced the discontinued TCL C845K with the TCL P755K as the best budget large TV for the UK.

12th September 2024

Removed the Sony A80L from the list due to lack of availability and promoted the LG C4 to the top spot. The 48-inch LG C4 has also taken the place of the 48-inch LG C3 as it now costs only a little more but is a decent-sized upgrade in terms of performance. We've also added the Sony Bravia 8 and Philips OLED809 to the 'also consider' section.

15th July 2024

Added the LG G4 to the also consider section.

23rd May 2024

Added the LG C4 as the best 2024 TV and replaced the Samsung S95C with the S95D in the also consider section

4th April 2024

Added the Samsung QN900D as the best 8K TV.

1st March 2024

'Also Consider' and 'Recent Updates' sections added and 'How We Test' section rewritten with additional detail.

1st February 2024

New author information and 'what is the best TV?' FAQ added.

12th January 2024

Information of new models announced at CES added to intro.

3rd November 2023

Added Sony A95L.

Round up of today's best deals

The latest hi-fi, home cinema and tech news, reviews, buying advice and deals, direct to your inbox.

Tom Parsons has been writing about TV, AV and hi-fi products (not to mention plenty of other 'gadgets' and even cars) for over 15 years. He began his career as What Hi-Fi?'s Staff Writer and is now the TV and AV Editor. In between, he worked as Reviews Editor and then Deputy Editor at Stuff, and over the years has had his work featured in publications such as T3, The Telegraph and Louder. He's also appeared on BBC News, BBC World Service, BBC Radio 4 and Sky Swipe. In his spare time Tom is a runner and gamer.